Madison Unit Trust

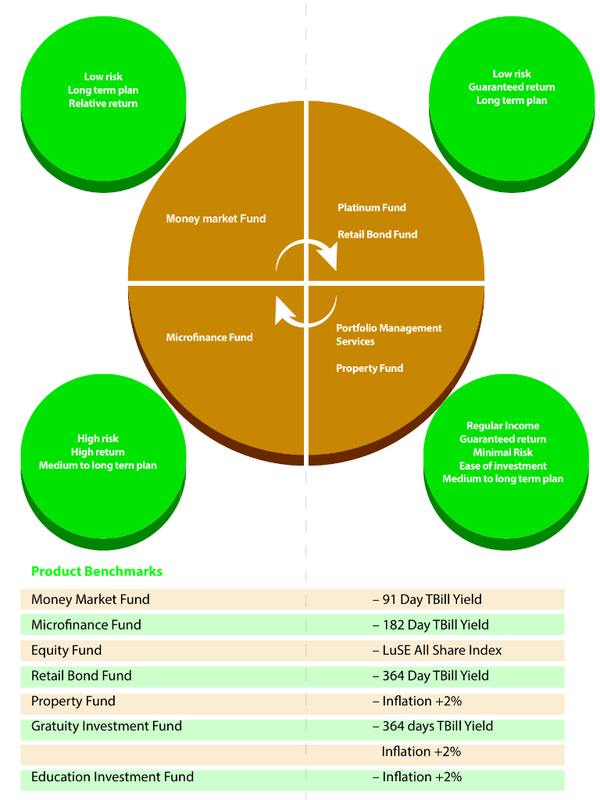

The mapping below compares level of risk and level of returns associated with the different Madison Unit funds.

Note: It is important to understand that the value of units may go up as well as down depending on the market conditions.

UNIT TRUST FREQUENTLY ASKED QUESTIONS

What is a Unit Trust?

A Unit Trust is a collective investment scheme, licensed by the Securities and Exchange Commission of Zambia, which enable individuals to pool their money into a fund, which is then invested in a wide spread of fixed interest securities and equities. Madison Unit Trusts are managed by Madison Asset Management Company Limited.

Unit Trusts funds are 'open-ended' to the extent that units can be created or cancelled as investors subscribe or redeem more money. Each person receives units depending on his/her investment. Each unit has the same value and is an undivided share of the portfolio.

How does a unit trust work?

An investor buys units in a unit trust fund, and the money is then invested by fund managers into a portfolio, which usually contains a mixture of assets including bonds and shares.

The fund is then managed by a professional fund manager who is better positioned to make wise investment decisions in order to ensure that maximum returns are achieved and consistent with the stated investment objectives.

How can you make money in Madison Unit Trusts?

Madison Unit trusts make money for you in two ways:

Distribution – the profits earned by the funds which are passed on to the investor (unit holders).

Distributions include interest from bonds and money market instruments and dividends from stocks held by the fund.

Through an increase in the value of the units held in the fund, also known as unit appreciation. As the value of the securities held in the fund increases so does the price of each unit held.

1. If the units are sold at a price higher than you paid for them, this represents a profit or capital gain.

2. If the units are sold at a price lower than you paid for them, this represents a loss.

How do I become a Unit Trust Holder?

Investors are required to fill out a Madison Unit Trust application form. Please ensure that the information provided on the Application form is correct. Kindly notify Madison Unit Trust should personal details change. Application forms can be obtained from our offices, our sales consultants and can also be downloaded from our website.

You are strongly advised to familiarize yourself with all declarations present on the form.

What documents are needed to enable a person open a unit trust account?

Investors from the United States and Canada are advised to contact Strategic Shift for information and the application process.

What Types of Funds are available?

Madison Unit Trust offers a choice of five funds which provide ideal vehicles for a diversified investment portfolio.

Madison Money Market Fund

This fund invests in a portfolio of short term money market instruments and aims to provide an above average return while protecting capital value.

The Madison money market fund is the safest of all funds as it has a stable net asset value this portfolio is suitable for individuals looking for regular income who might need money for an emergency. It is most suitable if your goals are short term i.e. 1-2 years.

Madison Equity Fund

This fund invests in carefully selected stocks listed on the Lusaka Stock Exchange, which have long term growth potential. It will buy stock from reputable companies displaying a strong potential for growth. This is a high-risk fund since it is subject to the volatility of share prices moving up and down. The minimum recommended investment period for this fund is five years.

Equity – refers to stock. A Stock is a security that represents an equity or ownership interest in a corporation. Changes in a firm’s earnings and financial condition have a major effect on its stock price. A portion of the firm’s profits may be paid as dividends to shareholders.

If your goals are long-term i.e.3-5 years or more and you are looking at saving for retirement, college fees for your children etc. the Equity Fund will be most suitable for you.

Madison Balanced Fund

This fund invests in equities and money market instruments in order to allow for long term growth and regular income.

A balanced fund is a fund made up of a mix of investment types (that is bonds, equities etc), actively managed by a fund manager. Individual investors receive ‘units’ relating to the amount they have invested.

In other words it is a hybrid portfolio of stocks and bonds.

If your goals are medium-term i.e. 2-5 years and you are looking for long term growth of your capital with a regular income, the balanced fund will be most suitable for you.

Madison Microfinance Fund

This fund invests in selected commercial papers and corporate bonds issued by non-bank financial institutions and providers. Commercial Paper is a staple of money-market instruments, short-term in nature, issued by large, creditworthy corporations

Madison Global Fund

This fund invests in foreign currency denominated portfolio of money market instruments providing capital preservation and regular income.

Note

An individual can invest in more than one Madison Unit Trust fund at a time.

Why should you invest in the Madison Unit Trusts?

Better returns than bank deposits: Madison Unit Trusts have been uniquely structured by experts who have in-depth knowledge of the money market, property market and performance of various shares in the stock market. Your money will be invested in a selection of well performing assets which should produce higher returns.

Simple & Convenient: Everyone needs to save for the future but not everyone knows how to achieve this and grow the value of their money. Our Unit Trust Fund service relieves clients from all the administrative hassles of managing internally their own investments. Madison Unit Trusts are also tailored to meet individual investor objectives whether this is investing for higher short–term returns or a long-term objective.

What are the benefits of investing in Madison Unit Trust funds?

There are many benefits that accrue of investing in the Madison Unit Trust Funds such as:

Diversification – By investing in a wide range of assets Madison Unit Trusts enable an investor access to a broad spread of listed shares and other securities without needing specific stock market, property market, international market or money market knowledge.

Professional fund management: Madison Unit Trusts are managed by professional portfolio managers with more expertise, experience, analysis, information and time than would be available to an individual investor and thereby enhancing the potential for high returns and long term capital growth.

Risk Control; Well defined investment philosophy & strategy acts as a guiding principle in defining the investment universe.

Flexibility: Madison Unit Trusts allow your units to be sold and the proceeds made available within a relatively short period of time.

Cost: To buy all the shares in a typical unit trust portfolio would be very expensive since dealing in small lots in individual shares is pricey. Equally, just to buy shares in a handful of companies would expose an investor to another level of risk entirely.

Economies of scale: Each investor can gain access to a much wider number of stocks via a unit trust than if he had tried to buy them individually.

Transparency; Clients will get account statements and performance reports on a regular basis. The following portfolio reports are prepared:

This helps investors to keep track of their Investment.

Safety of Your Investment: Because we understand how important your investment is to you, Madison Unit Trusts have been designed to offer you higher than average returns at a lower - than average risk.

Choice of various funds: Madison Unit Trusts offer vehicles which range from higher short–term return to long-term capital growth funds.

Professional Management; The service offers professional management of client investments with an aim to deliver consistent return with an eye on risk.

Constant Portfolio Tracking; MAMCo understands the dynamics of investments, so we track clients investments continuously to maximize the returns.

Performance; The Group has been successfully managing funds with excellent performance over the years. By building on this experience Madison Unit Trust is able to provide superior returns on our clients’ funds who invest in our unit trust funds.

Who Are the Main Parties Involved With the Trust?

The Main parties involved with the trust are you (the investor), the Fund Manager, the trustee and the custodian:

Do Unit Trusts offer a guaranteed return?

Unit trust fund values may change on a daily basis and there is no guarantee on the repetition of past performance. It is therefore important for investors to understand that investments are subject to market conditions. The price of units and the income from them may fluctuate and cannot be guaranteed.

Can I Hold More Than One Unit Trust Account?

A unit holder can open more than one unit trust account if they please. However it is more cost effective to hold one account so that fees / charges are not applied to each account individually.

Can I Invest Unit Trusts On Behalf Of My Children?

You are able to open the unit trust account in the minor’s name. As the parent or legal guardian, you will be required to sign all documentation until the minor reaches the age of 18.

How Long Should I Invest In A Unit Trust Fund?

This is depends on an individual’s investment goals. Define your investment needs:

Am I allowed to switch between funds or Transfer units from one fund to another?

Yes you are allowed.

What Is The Difference Between A Transfer And A Switch?

A transfer is the transfer of ownership from one person to another within the same unit trust fund. This can occur due to death, crediting a beneficiary or a third party etc. A client can transfer units to a person who is not an existing unit holder provided that a new application form is filled accompanying the transfer form.

A switch is when the owner remains the same, but the unit holding is moved from one fund to another. Unit holders can switch a portion if they would like to diversify their portfolio.

The minimum investment lump sum is still a necessary requirement for above transactions.

Switches

Clients may switch between funds at a fee of 1% of the amount that is being switched.

Transfers

1. This is the transfer of ownership from one person to another. Transfers occur within the same unit trust fund.

2. This instruction must be submitted in writing.

3. If the beneficiary / transferee is not a client at Madison Unit Trust a new Application form would be required along with the transfer form.

Why Do Unit Prices Fluctuate?

They fluctuate in accordance with the fluctuating prices of the underlying securities, which make up the respective fund’s unit trust portfolio

Can I Fax In My Requests?

We do accept instructions received by fax provided that it is legible.

A free format letter or a switch, transfer, buying form, selling form etc can all be faxed to us. However Madison Unit Trusts must have an original copy of the Application form.

What are the different accounts I can open for a Unit Trust?

Note

Investors from the United States and Canada are advised to contact Strategic Shift for information and the application process.

Individual Accounts

This is an account held by an individual investor

Joint Accounts

A joint account means that both parties have joint ownership of the units.

This should be checked off on the Application form

Attachments to the Application form

a. Specimen signatures of each joint holder should be provided

b. If you wish to assign additional signatories to your account, please provide full details in writing with your own signature and identity particulars, along with those of your additional signatories for future reference. This will be referred to before transactions can be authorized.

Corporate Accounts

Madison Unit Trust welcomes investments from companies, associations, groups, cooperatives etc

Attachments to the Application form

a. A copy of the most recent board meeting minutes / letter from the most senior person of the organization certifying who the authorized signatories are

b. All specimen signatories of a company account must be provided

c. Copies of ID particulars of all authorized signatories to authenticate signatures

In which types of unit trust should I invest?

The types of unit trust suitable for your personal investment needs depend on many variables, including your financial circumstances and objectives, your age and your tolerance for risk. One of the most important factors is your investment objective. It is important to determine whether you want to earn income or simply preserve your principal. Generally, equity unit trusts seek capital growth with commensurate risk, while fixed income trusts focus on preservation of principal and generating regular income.

A Madison Unit Trust Financial Advisor can help you determine which unit investment trust matches your needs and can provide you with a prospectus for a particular trust. The prospectus will contain detailed information as to charges, expenses and risks. Read it carefully before you invest.

Can I reinvest a distribution from a trust?

Yes. Most MUTs offer a reinvestment plan. These plans allow you to increase the number of units you hold, enabling you to reinvest in additional units with no sales charge on your reinvestment units.

Can I sell my units?

You may sell all, or a portion of, your units any day the stock market is open. You will receive the then-current net asset value of the units, based on the current market value of the underlying securities in the portfolio, less any deferred sales charge, as of the evaluation time. As the market fluctuates, of course, so will the value of your units. Therefore, your units may be worth more or less than what you originally paid.

Who manages the unit trust investments?

The funds collected in the unit trust are managed by a fund manager. It is he who collects the funds from the public and invests them on their behalf. There is a provision for a trustee who is vested with the ownership of the trust. The trustee ensures that the funds are invested by the fund managers according to the investment objectives of the trust.

Can I receive income?

Yes, you can receive income in the same way as you would for direct investment into stocks and shares. This income is taxable. You can also opt to have any income accumulated into your investment. In this case the money is used to buy more units at the price on the day of re-investment.

Can I lose my money?

For the Money Market Fund it is not possible to lose your money, however in the Equity Fund there is a risk to your capital because you are making a stock market investment, albeit through a collective investment scheme. However, your risks are normally much lower than investing directly into stock market assets. A unit trust portfolio may have over 6 holdings and your risk is spread across all of these. The misfortunes of one company will not have such a dramatic impact on your investment, as they would have if you invested solely into that company. Amongst the whole range of unit trusts available, there are those suited to more cautious investors and those for the more aggressive. Trusts categorized as aggressive have a higher level of risk than cautious or secure trusts.

Why should I choose a unit trust with Madison Unit Trust?

As well as ensuring expert fund managers look after your investment, we pride ourselves on the service we provide.

Contact us on –0211 223023 or 0211 223025

Available between 8am and 5pm Monday to Friday (this does not apply to Public Holidays), our Customer Services team is on hand to help you whenever you need information.

What is the ideal timeframe for an investment?

For money market funds we recommend that you invest between one to two years for. Equity Funds are generally long-term investments, and at least three to five years is usually recommended. Why? Because unit trusts offer diversification of risk via a portfolio of stocks; as such, it will take time for the portfolio to produce a return.

When should I buy?

There is no 'right' time to buy. Too many investors imagine they can perfect investment timing – so they become preoccupied checking the fluctuations in daily prices before committing. This is folly. As professionals we don't do this because we know that markets discount expected news and there are, anyway, many irrational influences that can move markets.

When should I sell?

Once invested, the hardest part is to know when to take profits or cut losses. Markets are proverbially a pull between greed and fear, and it is these emotions that can impel investors to hang on to paper gains too long or sell too quickly. If you're thinking of selling, ask yourself simply if you have given an investment enough time to perform, whether you have reached your objectives and how the underlying fund/market prospects appear.

How do I sell?

You can sell your units at Madison Unit Trust from whom you purchased your units. Realization proceeds will be paid out within 24 hours days for income based funds and 48 for other funds. If your units were purchased with cash, the proceeds will be paid to you/ your agent in the form of a cheque.

A Unit Trust is a collective investment scheme, licensed by the Securities and Exchange Commission of Zambia, which enable individuals to pool their money into a fund, which is then invested in a wide spread of fixed interest securities and equities. Madison Unit Trusts are managed by Madison Asset Management Company Limited.

Unit Trusts funds are 'open-ended' to the extent that units can be created or cancelled as investors subscribe or redeem more money. Each person receives units depending on his/her investment. Each unit has the same value and is an undivided share of the portfolio.

How does a unit trust work?

An investor buys units in a unit trust fund, and the money is then invested by fund managers into a portfolio, which usually contains a mixture of assets including bonds and shares.

The fund is then managed by a professional fund manager who is better positioned to make wise investment decisions in order to ensure that maximum returns are achieved and consistent with the stated investment objectives.

How can you make money in Madison Unit Trusts?

Madison Unit trusts make money for you in two ways:

Distribution – the profits earned by the funds which are passed on to the investor (unit holders).

Distributions include interest from bonds and money market instruments and dividends from stocks held by the fund.

Through an increase in the value of the units held in the fund, also known as unit appreciation. As the value of the securities held in the fund increases so does the price of each unit held.

1. If the units are sold at a price higher than you paid for them, this represents a profit or capital gain.

2. If the units are sold at a price lower than you paid for them, this represents a loss.

How do I become a Unit Trust Holder?

Investors are required to fill out a Madison Unit Trust application form. Please ensure that the information provided on the Application form is correct. Kindly notify Madison Unit Trust should personal details change. Application forms can be obtained from our offices, our sales consultants and can also be downloaded from our website.

You are strongly advised to familiarize yourself with all declarations present on the form.

What documents are needed to enable a person open a unit trust account?

- Completed Madison Unit Trust Application form and signed.

- A copy of ID particulars / passport to authenticate signature

- Passport size photo.

- Reference letter or copy of recent utility bill (if bills comes in your own name)

Investors from the United States and Canada are advised to contact Strategic Shift for information and the application process.

What Types of Funds are available?

Madison Unit Trust offers a choice of five funds which provide ideal vehicles for a diversified investment portfolio.

Madison Money Market Fund

This fund invests in a portfolio of short term money market instruments and aims to provide an above average return while protecting capital value.

The Madison money market fund is the safest of all funds as it has a stable net asset value this portfolio is suitable for individuals looking for regular income who might need money for an emergency. It is most suitable if your goals are short term i.e. 1-2 years.

Madison Equity Fund

This fund invests in carefully selected stocks listed on the Lusaka Stock Exchange, which have long term growth potential. It will buy stock from reputable companies displaying a strong potential for growth. This is a high-risk fund since it is subject to the volatility of share prices moving up and down. The minimum recommended investment period for this fund is five years.

Equity – refers to stock. A Stock is a security that represents an equity or ownership interest in a corporation. Changes in a firm’s earnings and financial condition have a major effect on its stock price. A portion of the firm’s profits may be paid as dividends to shareholders.

If your goals are long-term i.e.3-5 years or more and you are looking at saving for retirement, college fees for your children etc. the Equity Fund will be most suitable for you.

Madison Balanced Fund

This fund invests in equities and money market instruments in order to allow for long term growth and regular income.

A balanced fund is a fund made up of a mix of investment types (that is bonds, equities etc), actively managed by a fund manager. Individual investors receive ‘units’ relating to the amount they have invested.

In other words it is a hybrid portfolio of stocks and bonds.

If your goals are medium-term i.e. 2-5 years and you are looking for long term growth of your capital with a regular income, the balanced fund will be most suitable for you.

Madison Microfinance Fund

This fund invests in selected commercial papers and corporate bonds issued by non-bank financial institutions and providers. Commercial Paper is a staple of money-market instruments, short-term in nature, issued by large, creditworthy corporations

Madison Global Fund

This fund invests in foreign currency denominated portfolio of money market instruments providing capital preservation and regular income.

Note

An individual can invest in more than one Madison Unit Trust fund at a time.

Why should you invest in the Madison Unit Trusts?

Better returns than bank deposits: Madison Unit Trusts have been uniquely structured by experts who have in-depth knowledge of the money market, property market and performance of various shares in the stock market. Your money will be invested in a selection of well performing assets which should produce higher returns.

Simple & Convenient: Everyone needs to save for the future but not everyone knows how to achieve this and grow the value of their money. Our Unit Trust Fund service relieves clients from all the administrative hassles of managing internally their own investments. Madison Unit Trusts are also tailored to meet individual investor objectives whether this is investing for higher short–term returns or a long-term objective.

What are the benefits of investing in Madison Unit Trust funds?

There are many benefits that accrue of investing in the Madison Unit Trust Funds such as:

Diversification – By investing in a wide range of assets Madison Unit Trusts enable an investor access to a broad spread of listed shares and other securities without needing specific stock market, property market, international market or money market knowledge.

Professional fund management: Madison Unit Trusts are managed by professional portfolio managers with more expertise, experience, analysis, information and time than would be available to an individual investor and thereby enhancing the potential for high returns and long term capital growth.

Risk Control; Well defined investment philosophy & strategy acts as a guiding principle in defining the investment universe.

Flexibility: Madison Unit Trusts allow your units to be sold and the proceeds made available within a relatively short period of time.

Cost: To buy all the shares in a typical unit trust portfolio would be very expensive since dealing in small lots in individual shares is pricey. Equally, just to buy shares in a handful of companies would expose an investor to another level of risk entirely.

Economies of scale: Each investor can gain access to a much wider number of stocks via a unit trust than if he had tried to buy them individually.

Transparency; Clients will get account statements and performance reports on a regular basis. The following portfolio reports are prepared:

- Performance Statements

- Transactions Statements

- Capital Gain/Loss Statements

This helps investors to keep track of their Investment.

Safety of Your Investment: Because we understand how important your investment is to you, Madison Unit Trusts have been designed to offer you higher than average returns at a lower - than average risk.

Choice of various funds: Madison Unit Trusts offer vehicles which range from higher short–term return to long-term capital growth funds.

Professional Management; The service offers professional management of client investments with an aim to deliver consistent return with an eye on risk.

Constant Portfolio Tracking; MAMCo understands the dynamics of investments, so we track clients investments continuously to maximize the returns.

Performance; The Group has been successfully managing funds with excellent performance over the years. By building on this experience Madison Unit Trust is able to provide superior returns on our clients’ funds who invest in our unit trust funds.

Who Are the Main Parties Involved With the Trust?

The Main parties involved with the trust are you (the investor), the Fund Manager, the trustee and the custodian:

- The investor (you) invests his monies with the Fund Manager and receives units in return which may earn interest and dividends depending on the fund type, fund performance etc

- The Fund Manager (Madison Unit Trust) utilizes the funds received from the investor to purchase securities contained in the unit portfolio. It invests the funds, markets the units and performs administrative functions.

- The trustee (AMG Global Chartered Accountant) protects the interests of the unit holders ensuring that the Fund Manager is performing its duties in accordance to the Act and is investing the funds in accordance to the prescribed investment policy of the unit trust fund.

Do Unit Trusts offer a guaranteed return?

Unit trust fund values may change on a daily basis and there is no guarantee on the repetition of past performance. It is therefore important for investors to understand that investments are subject to market conditions. The price of units and the income from them may fluctuate and cannot be guaranteed.

Can I Hold More Than One Unit Trust Account?

A unit holder can open more than one unit trust account if they please. However it is more cost effective to hold one account so that fees / charges are not applied to each account individually.

Can I Invest Unit Trusts On Behalf Of My Children?

You are able to open the unit trust account in the minor’s name. As the parent or legal guardian, you will be required to sign all documentation until the minor reaches the age of 18.

How Long Should I Invest In A Unit Trust Fund?

This is depends on an individual’s investment goals. Define your investment needs:

- What do you plan to use the money for?

- When do you plan to use the money?

- How much risk can you tolerate?

Am I allowed to switch between funds or Transfer units from one fund to another?

Yes you are allowed.

What Is The Difference Between A Transfer And A Switch?

A transfer is the transfer of ownership from one person to another within the same unit trust fund. This can occur due to death, crediting a beneficiary or a third party etc. A client can transfer units to a person who is not an existing unit holder provided that a new application form is filled accompanying the transfer form.

A switch is when the owner remains the same, but the unit holding is moved from one fund to another. Unit holders can switch a portion if they would like to diversify their portfolio.

The minimum investment lump sum is still a necessary requirement for above transactions.

Switches

Clients may switch between funds at a fee of 1% of the amount that is being switched.

Transfers

1. This is the transfer of ownership from one person to another. Transfers occur within the same unit trust fund.

2. This instruction must be submitted in writing.

3. If the beneficiary / transferee is not a client at Madison Unit Trust a new Application form would be required along with the transfer form.

Why Do Unit Prices Fluctuate?

They fluctuate in accordance with the fluctuating prices of the underlying securities, which make up the respective fund’s unit trust portfolio

Can I Fax In My Requests?

We do accept instructions received by fax provided that it is legible.

A free format letter or a switch, transfer, buying form, selling form etc can all be faxed to us. However Madison Unit Trusts must have an original copy of the Application form.

What are the different accounts I can open for a Unit Trust?

Note

Investors from the United States and Canada are advised to contact Strategic Shift for information and the application process.

Individual Accounts

This is an account held by an individual investor

Joint Accounts

A joint account means that both parties have joint ownership of the units.

This should be checked off on the Application form

Attachments to the Application form

a. Specimen signatures of each joint holder should be provided

b. If you wish to assign additional signatories to your account, please provide full details in writing with your own signature and identity particulars, along with those of your additional signatories for future reference. This will be referred to before transactions can be authorized.

Corporate Accounts

Madison Unit Trust welcomes investments from companies, associations, groups, cooperatives etc

Attachments to the Application form

a. A copy of the most recent board meeting minutes / letter from the most senior person of the organization certifying who the authorized signatories are

b. All specimen signatories of a company account must be provided

c. Copies of ID particulars of all authorized signatories to authenticate signatures

In which types of unit trust should I invest?

The types of unit trust suitable for your personal investment needs depend on many variables, including your financial circumstances and objectives, your age and your tolerance for risk. One of the most important factors is your investment objective. It is important to determine whether you want to earn income or simply preserve your principal. Generally, equity unit trusts seek capital growth with commensurate risk, while fixed income trusts focus on preservation of principal and generating regular income.

A Madison Unit Trust Financial Advisor can help you determine which unit investment trust matches your needs and can provide you with a prospectus for a particular trust. The prospectus will contain detailed information as to charges, expenses and risks. Read it carefully before you invest.

Can I reinvest a distribution from a trust?

Yes. Most MUTs offer a reinvestment plan. These plans allow you to increase the number of units you hold, enabling you to reinvest in additional units with no sales charge on your reinvestment units.

Can I sell my units?

You may sell all, or a portion of, your units any day the stock market is open. You will receive the then-current net asset value of the units, based on the current market value of the underlying securities in the portfolio, less any deferred sales charge, as of the evaluation time. As the market fluctuates, of course, so will the value of your units. Therefore, your units may be worth more or less than what you originally paid.

Who manages the unit trust investments?

The funds collected in the unit trust are managed by a fund manager. It is he who collects the funds from the public and invests them on their behalf. There is a provision for a trustee who is vested with the ownership of the trust. The trustee ensures that the funds are invested by the fund managers according to the investment objectives of the trust.

Can I receive income?

Yes, you can receive income in the same way as you would for direct investment into stocks and shares. This income is taxable. You can also opt to have any income accumulated into your investment. In this case the money is used to buy more units at the price on the day of re-investment.

Can I lose my money?

For the Money Market Fund it is not possible to lose your money, however in the Equity Fund there is a risk to your capital because you are making a stock market investment, albeit through a collective investment scheme. However, your risks are normally much lower than investing directly into stock market assets. A unit trust portfolio may have over 6 holdings and your risk is spread across all of these. The misfortunes of one company will not have such a dramatic impact on your investment, as they would have if you invested solely into that company. Amongst the whole range of unit trusts available, there are those suited to more cautious investors and those for the more aggressive. Trusts categorized as aggressive have a higher level of risk than cautious or secure trusts.

Why should I choose a unit trust with Madison Unit Trust?

As well as ensuring expert fund managers look after your investment, we pride ourselves on the service we provide.

Contact us on –0211 223023 or 0211 223025

Available between 8am and 5pm Monday to Friday (this does not apply to Public Holidays), our Customer Services team is on hand to help you whenever you need information.

What is the ideal timeframe for an investment?

For money market funds we recommend that you invest between one to two years for. Equity Funds are generally long-term investments, and at least three to five years is usually recommended. Why? Because unit trusts offer diversification of risk via a portfolio of stocks; as such, it will take time for the portfolio to produce a return.

When should I buy?

There is no 'right' time to buy. Too many investors imagine they can perfect investment timing – so they become preoccupied checking the fluctuations in daily prices before committing. This is folly. As professionals we don't do this because we know that markets discount expected news and there are, anyway, many irrational influences that can move markets.

When should I sell?

Once invested, the hardest part is to know when to take profits or cut losses. Markets are proverbially a pull between greed and fear, and it is these emotions that can impel investors to hang on to paper gains too long or sell too quickly. If you're thinking of selling, ask yourself simply if you have given an investment enough time to perform, whether you have reached your objectives and how the underlying fund/market prospects appear.

How do I sell?

You can sell your units at Madison Unit Trust from whom you purchased your units. Realization proceeds will be paid out within 24 hours days for income based funds and 48 for other funds. If your units were purchased with cash, the proceeds will be paid to you/ your agent in the form of a cheque.